stop on quote versus stop limit on quote

Trailing stop limit orders offer traders more control over their trades but can be risky if the price falls fast. A limit order will then be working at or better than the limit price you entered.

It enables an investor to have some downside.

. Your limit price must be lower than or equal to your stop price when selling and must also be within 9 per cent of your stop price. In contrast a sell stop order executes at a stop price below the current market price. Stop Loss Limit Etrade changed the stop loss function some time ago.

So once ADA hits 230 it will put a limit sell order that will trail the highest price by 2. While stop losses are a good way to limit your losses they are also a way to solidify your gains. A buy stop order executes at a stop price that is above the current market price.

Lets first have a look at trailing stop losses in general and then go on to exploring. Stop on quote orders can. Trailing stop orders may have increased risks due to their reliance on trigger pricing which may.

A visitor stands in front of private stock trading boards at a private stock. Just use stop orders. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better.

Stop on Quote vs. It has no limit on the eventual trading price. Stop loss orders ensure your trade is executed at the current market price meaning slippage may occur.

A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. When they do it. A limit order guarantees price but not an execution.

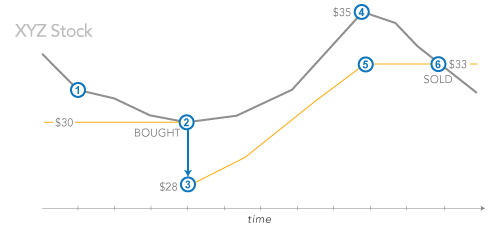

Learn how to use these orders and the effect this strategy may have on your investing or trading strategy. Stop-loss and stop-limit orders are common strategies used by traders and investors looking to limit losses and also to protect gains. The stop price and the limit price for a stop-limit order do not have to be the same price.

The stop price is a price that is above the market price of the stock whereas the limit price is the highest price that a trader is willing to pay per share. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. When you pass the trigger price the order goes in as a limit order.

When the stop price is triggered the limit order is sent to the exchange. So if ADA hits 230 and then drops to 229 it will not sell. Limit orders are executed automatically as soon as there is an opportunity to trade at the limit price or better.

With a stop limit order traders are guaranteed that if they receive an execution it will. You can place whats known as a trailing. For example if the trader in the previous scenario enters a stop-limit order at 25 with a limit of 2450 the order triggers when the price.

The trade will only execute at the set price or better. Limit is an important distinction that can significantly change the outcome of your order. A stop-loss is a transaction triggered when a futures contract hits a certain price level.

The purpose of a stop loss is to set the mark below which you take your money and run. If it jumps up 245 it will then have a new price of 24019 that will be the limit sell price and you would have gotten a. It is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far.

A limit order is an order to buy or sell a set number of shares at a specified price or better. Think of the stop as a trigger that will initiate the purchasesale and the limit as a condition. For example if John intends to buy ABC Limited stocks that are valued at 50 and are expected to go.

A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price. It enables an investor to have some downside. Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position.

Use stop loss orders if you want to ensure your trade is executed no matter the price. A stop loss is a type of stop limit where you create a limit sell order when the stock falls below a certain mark. Bad thing about SLOQ is if there isnt a good BID support you may take a huge loss from what you set your price at as the computer works its way down the BID side selling your stock off.

Stop limit orders are slightly more complicated. To protect a portion of their gains 15 the trader places a sell order to stop at 170. 2 days agoStop-loss order.

Account holders will set two prices with a stop limit order. A stop order on the other hand is used to limit losses. A stop-on-quote order is an order to buy or sell a security when its price surpasses a particular point limiting your loss or.

The answer is that stop-limit orders are actually a combination of two individual orders. Lets consider a trader who bought FB for 155 and it is now trading at 185. When the stop price is reached a limit order is triggered.

An effective way to limit the loss by stocks price fall. For example a sell stop limit order with a stop price of 300 may have a limit price of 250. Stop-limit orders also trigger when the contract price hits a certain level.

For a retail trader like yourself theres no practical benefit to stop limits. This frees the investor from monitoring prices and allows the investor to lock in profits. Stop limit orders ensure theres no slippage from your set price but your trade wont be executed if the price is unavailable due to low liquidity.

The stop price and the limit price. When you pass the trigger price order goes in as a standard limit order. The stop price is when the first part of the order is executed but unlike a limit order the stock wont actually be bought or sold immediately when the stop price hits.

On the other hand a trailing stop limit order will send a limit order once the stop price is reached meaning that the order will be filled only on the current limit level or better. Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. When the stock reaches your stop price your brokerage will place a limit order.

Copy Forex Forexfactory Index Trading สอน เทรด Forex Copy Trading Forex สอน เทรด 007 Forexfactory Index Forex Trading Trading Quotes Trend Trading

Trading Up Close Stop And Stop Limit Orders Youtube

Account Suspended Neymar Jr Neymar Neymar Memes

You Ll Figure It Out For Yourself Life Quotes Family Inspirational Quotes With Images Quotable Quotes

If You Still Think About It You Still Care About It Words Of Widsom Thoughts And Feelings Care Quotes

Stop Limit Order Example Free Guide With Charts

Age Is No Barrier It S A Limitation You Put On Your Mind Age Difference Quotes Aging Quotes Age Difference Relationship

Potentially Protect A Stock Position Against A Market Drop Learn More

Eat What You Want Embrace Your Real Quote Real Quotes Daily Words Of Wisdom Quotes

Potentially Protect A Stock Position Against A Market Drop Learn More

Pin On Forex Guide The Absolute Basics Of Forex Trading

Never Quit Never Stop Challenging Yourself Never Settle For Less Than What You Want Always Keep Goi Inspirational Quotes Gym Quote Fitness Motivation Quotes

The Only Person That Can Stop You From Reaching Your Goals Is You Don T Limit Yourself With Negativ Quotes To Live By Positive Mental Attitude Positive Quotes

Quotes Givers Need To Set Limits Because Takers Rarely Do Encouragement Quotes Motivational Quotes Work Quotes

Limit Order Vs Stop Order Difference And Comparison Diffen

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov